This page is prepared by Kayra Uzun and Hilal Gümüşlü as a part of ECON 318 requirements at Bilkent University for the Fall 2018-2019 semester. The purpose of this page is to assess the possibility of an oil pipeline between Iran & Russia to evade economic sanctions imposed on Iran. The evidence gathered here is valid by 23.XII.2018.

Summary

Iran is one of the most important crude oil producer. After the US sanctions Iran and Russia may decrease the effect of sanctions by establishing a pipeline between Iranian Caspian port Neka and Russian Caspian port Makhachkala and from Makhachkala to Russian Black Sea port Novorossiysk. The proposed capacity of the pipeline to be built is 500,000 bpd. The Neka-Makhachkala-Novorossiysk pipeline has a length of 1810 km. The estimated cost of the proposed project is $2.71B. The crude that Iran may export is Iranian Light blend. Given that Russia starts importing Iranian oil, their trade balance indicate that, they might trade in local currencies. Russia may utilize Iranian Light to counteract the rising discontent in Europe regarding Urals blend. Moreover, as Iranian blends have comparatively higher proportion of mid-distillates, this pipeline can serve as a lucrative tool for both Iran and Russia in the midst of sanctions against Iran.

A major challenge on this issue is the legal status of the Caspian Sea. It treats the seabed as territorial zones. This means that the proposed pipeline between Iran and Russia has to go through the territory of another littoral Caspian state. The interest of Azerbaijan, Kazakhstan and Turkmenistan in such a project and agree with letting it built might be, their own plans to build an East-West pipeline towards Europe to increase their agency and independency. Feasibility of the pipeline project seems promising, as Caspian’s depth is relatively low, and necessary pipeline laying ships can be brought to Caspian Sea from Black Sea.

Alternatively, maritime shipment between Neka and Makhachkala seems less feasible. Maritime shipment appears to be not feasible in terms of number of tankers required. The transportation cost of 500,000 bpd is approximately $0.77B per year. In about just 3.5 years, the shipping becomes more expensive than the pipeline project. Although, shipment deals can be altered really easily, making this option more versatile, in case US sanctions are lifted in the future, or Iran-Russia relationship deteriorates, it is not feasible either in terms of Russian and Iranian fleet size in Caspian Sea, or economic outlook. On the other hand, a pipeline can act as leverage for both Iran and Russia in its future international dealings, and it might be a better investment, when the long-term opportunities, and the long-term economic efficiency of pipelines are considered.

Caspian Sea Project

The Caspian Sea is surrounded by five countries which are called the “Caspian States” which are; Azerbaijan, Iran, Kazakhstan, Russia and Turkmenistan. The location of the Caspian waters holds a strategic importance in international geopolitics. Neither the international marine laws nor the laws of inland lakes apply directly to the Caspian waters.

Immense offshore hydrocarbon resources in the Caspian waters combined with its strategic location has made it into a top priority for the littoral states. Its strategic importance has increased the pressure to find a legal solution with which the coastal counties can all agree.

On August 12th, 2018, the 5th convention of legal status of the Caspian Sea, so called “Caspian Agreement” was signed. However, this does not mean the Caspian Agreement has resolved all the problems. The outline of legal status of the Caspian is given in general terms, the details are left behind.

If Caspian waters are considered as a lake, it is divided equally among five states (see Table 1). If it is considered as a sea, the maritime borders are determined based on its coastline. Iran has one of the shortest coastlines, thus supports the Caspian being a lake, mainly over its security concerns. Russia wants to access the whole lake for militaristic purposes, so Russia does not support neither shared lake nor shared sea view. Rather, Russia would prefer Caspian waters to be considered as international waters on the surface, so that it can have access to every point. For Turkmenistan and Azerbaijan, having greater access to gas and oil reserves is the main concern. However, with the convention signed on August 12th, 2018, the waters are treated as international waters meaning, the water surface above can be accessed by any country. This also creates an ambiguity; international water treatment of the surface water does not fit the conditions of shared sea nor shared lake. Seabed on the other hand will be treated as territorial zones, determined by other treaties, meaning, again, it is neither a shared sea nor a lake. Thus, convention doesn’t state Caspian as sea or lake. But, due to international water treatment, Caspian will be named more suitably as Caspian Sea.

41% of total crude oil reserves of countries in the Caspian region are located within the Caspian Sea. The total reserves of 48 billion barrels (bbl.) in Caspian region (onshore, offshore reserves combined) constitute 15.9% of total proven oil reserves in the five countries. The oil production in Caspian Sea compared to total production in neighboring countries corresponds to 9.83%.

For natural gas, 36% of natural gas reserves of the Caspian countries are located in offshore fields in Caspian Sea. This corresponds to 292 trillion cubic feet (Tcf) of proved natural gas reserves.

Iran’s oil production from the Caspian Sea is negligible. Same is true for Russia. On the other hand, majority of Azerbaijan and Kazakhstan oil production originates from the Caspian Sea. Also, Turkmenistan does not have the infrastructure for exploiting its oil or gas reserves.

The convention on the legal status of Caspian Sea makes is theoretically possible for countries to lay pipelines. The caveat is the convention does not clarify how the seabed will be shared among countries. However, all the countries have something to gain by resolving the disputes.

Turkmenistan with the help of the proposed Trans-Caspian Pipeline (TCP) to Azerbaijan can pick up its slowing economy, end its dependence on China, widen its customer range and find European partners that are more likely to invest in its vast natural gas reserves.

Kazakhstan might utilize an oil pipeline towards Baku-Tiflis-Ceyhan (BTC) to boost its trade volume, decrease its absolute dependency on Russia and China for energy transportation, increase the profit it makes from its oil trade and gives leverage as an alternative in its trade deals with other parties.

Azerbaijan may turn into an energy hub that feeds oil and gas to Europe, Turkey, and the Mediterranean by providing Turkmenistan gas and Kazakhstan oil. This advances its geopolitical importance, giving leverage in its deals with Russia, Iran, Europe and other third parties.

Iran may use a potential pipeline to Russia to evade the US sanctions. This way, it can decrease its dependency in US dollar and SWIFT system by dealing with Russia in local currencies and pick up its slowing economy and decreasing export revenues.

Russia by “allowing” an East-West energy corridor in the Caspian Sea can cause Kazakhstan and Turkmenistan to gravitate back towards Russian sphere of influence away from China. Moreover, economically stronger Turkmenistan might stand stronger against any potential Islamist extremist spillage from Afghanistan, securing Russian border. Also, helping Iran to evade the US sanctions by transporting its oil gives additional revenue and leverage against Russia’s negotiations with the US and decreases the US dollar trade that Russia conducts.

There is a possibility of a deal, that can allow fourth largest oil producer (Iran), to continue supplying oil to world, with the help of Russia and its Black Sea port Novorossiysk. Analysis shows that, both Iran and Russia have the pipeline infrastructure that has connections to a Caspian port city. Two countries can trade oil via ships, or a potential pipeline to be constructed between these two port cities. More importantly, Russia can start importing Iranian oil, which would actually close the trade imbalance between the countries, allowing them to trade in local currencies. However, preliminary analysis shows that, shipping oil from Iran seems much more plausible (click links for details) than constructing a pipeline between two countries.

Iranian oils can be classified as sour light/medium oils. The light, sour Iranian oils are Iranian Light, Lavan and Sirri. It doesn’t have any sweet crude oil types that are (ultra) light as well. Comparing the blends that Iran exports, there are several alternatives to it that are mainly produced in Middle East states or littoral Caspian states. Although this might imply competition, it also means, if one of its alternative’s quality is deteriorating, Iranian blends can be used to keep its quality. This case applies for Russia’s Ural Blends, as the quality of the Ural Blend that is being exported to Europe has been deteriorating in the recent years.

Therefore, this opens up the possibility of a potential trade deal between Russia and Iran. If Russia decides to import the Iranian oil, they might do it in local currencies to avoid U.S. sanctions. Russia can use the Iranian oil imports to improve the quality of Urals blend, or it can direct the oil to China by mixing it with ESPO blend. However, in both cases, the only desirable Iranian blend is Iranian Light, which is the 2nd most produced Iranian oil blend.

To transport the Iranian oil, a potential pipeline between Iran’s Caspian Sea port city Neka and Russia’s Caspian Sea port city Makhachkala can be built. The estimated project cost for such pipeline is estimated around $2.71B, with a capacity of 500,000 bpd and length 1810 km.

Legal Status of the Caspian Sea and Interests of Neighboring Countries

“Caspian Sea’s location at the crossroads of Asia, Europe, and the Middle East has kept the region’s strategic importance to international geopolitics.” (Karbuz, 2016).

“The

controversy over the legal regime of the Caspian Sea began with the

breakup of the Soviet Union in 1991. Until then, the Caspian had been

considered a common sea between Iran and the Soviet Empire. However,

following the collapse of the Soviet Union, the number of littoral

states increased from two to five, which in turn dramatically altered

the geopolitical dynamic. The birth of the new nation-states along

the perimeter of the Caspian Sea transformed the region into an area

of conflict, and its legal regime has become one of the contentious

disputes among the bordering countries. The existence of immense

offshore hydrocarbon resources in the Caspian Sea along with its

strategic location on a geopolitically significant transport route

have made it into a top priority in the foreign and domestic policies

of the littoral states. Its strategic importance has moreover

increased the pressure to find a legal solution on which the coastal

countries can agree; currently they hold different views on the

delimitation of the sea (surface waters).” (Abilov, 2013).

“Can the disputes over the legal status and regime of the Caspian Sea be resolved by the international laws?” Since the name of the Caspian is still not legally set as sea or lake, no international law is applicable (Karbuz, 2016).

International law does not bring a solution because the Caspian Sea which is a closed pond with no direct connection to the oceans, is either a sea or a lake, does not fully comply with the existing definitions of international law. This distinction is extremely important because of the different ways of sharing a lake or a sea. In the definition of “sea”, sharing rights are based on the United Nations Maritime Law. In the definition of “lake”, the sharing rights are allocated to the riparian states in equal sectors. In the middle of it all, there are different parameters from a puddle: Sea floor, subsoil, water layer, water surface and airspace.

First of all, when we examine in terms of oil and gas resources, sharing the seabed among these five countries seems like an important point and in terms of pipelines, sharing the sea floor is another important one. When we analyze from a military point of view, there are several issues to negotiate such as the water body, the water surface, and the airspace. In this region, fishery is a part of the issues of sharing the water body and the water surface. In order to solve the Caspian problem, senior officials of the foreign ministries of the riparian country met 52 times, foreign ministers met six times and held four summits at heads of the state level. Finally, on August 12th 2018, the fifth summit in Kazakhstan was finalized with signing of a 24-item agreement. The agreement will come into force after adoption in the councils of the riparian countries. However, this does not mean the Caspian Agreement has solved the problems. The issue of sharing in the Caspian is given in general terms, the details are left behind. The reference points that will form the basis of the determination of the borders are left to the mutual negotiations between the parties.

The agreement does not make it clear whether the legal status of the Caspian is a sea or a lake. However, the agreement accepts Caspian as a lake on some issues and accepts as a sea on some other issues. On the basis of international law, Azerbaijan, Iran and Turkmenistan are expected to reach an agreement to share the seabed by bilateral and tripartite talks. Iran, meanwhile, says it will not utilize any of its energy sources in the region, where reference points and sectors have been set up. Also, it is noteworthy that most of the 24 articles in the agreement are on military and security cooperation:

1) The riparian countries will not interfere in each other's internal affairs.

2) A non-coastal country will not have a military presence in the Caspian Sea and will not be able to take any military action against another Caspian country over a Caspian country. These decisions to keep the US and NATO away from the region seem to be a very important achievement for Russia and Iran. From this perspective, the agreement has significant gains for Russia and Iran. Another potential would be the Caspian Economic Forum, which Russia is attempting to establish, as well as a new North-South transportation and logistics corridor to be built, and Russia's fall into the hot seas, and the role that Iran will play in this (Karbuz, 2018)

Treating Caspian as a lake requires states to divide lake evenly, 20% to each. If it is treated as a sea, the division is done based on coastline length and maritime borders (Carroll, 2018; Indeo, 2018).

Table 1 - Distribution of Caspian Sea based on different statuses

|

Countries |

Coastline Length |

Proportion of Coastline (Law of shared sea) |

Share of Caspian Lake (Law of shared lake) |

|

Azerbaijan |

955 km |

16.2% |

20% |

|

Kazakhstan |

2320 km |

39.4% |

20% |

|

Iran |

724 km |

12.3% |

20% |

|

Russia |

695 km |

11.8% |

20% |

|

Turkmenistan |

1200 km |

20.4% |

20% |

Sources: Carroll, 2018; Azerbaijan.az, 2018

Table 1 suggests that Iran is the biggest supporter of establishing Caspian Sea as a lake. Also, Russia’s majority of energy production comes from other areas and thus, its main concern in Caspian region is not the amount of area it has, but rather militaristic control over it and singlehandedly controlling the energy flow to Europe. However, Russia’s main interest in Caspian region is not the north sections, but rather the southern areas. The reason is, the Russian navy can conduct operations in Syria if they are positioned in the South. Thus, having military access to South allows Russia to exert influence over Middle East, an area where its interest clash with the US. On the other hand, Iran wants to control waters that are close to its borders, meaning the southern section for security and sovereignty concerns. If Iran has the control of the southern section militarily, it can use it as leverage against other countries, especially Russia.

Due to lack of rigid laws and rules on Caspian Sea bonded by agreements, many areas were disputed, over territorial claims. All five states had to agree to execute a pipeline proposal which blocked many deals in the previous years (Karbuz, 2016; Carroll, 2018; Kramer, 2018).

The 5th Convention on Legal Status of Caspian Sea takes bits from both treating it as a lake and sea. Surface is treated as international water, meaning no one can have claim of sovereignty on the water. This mainly interests Russia and Iran, especially Russia. This is because, Russia wants military access to Middle East, over its political and diplomatic goals. South Caspian Sea actually is close enough to Syria to allow Russia to perform military actions with it ships from there. However, South Caspian Sea is really far away from Russian soil. Thus, the only case in which Russia accesses this region is by declaring the surface of Caspian Sea international waters. Seabed on the other hand is divided into territorial zones. This convention leaves the agreement on a pipeline project to those countries which have the pipeline on their territory, although other states can challenge this on environmental concerns. However, Russia finally agreeing on such a convention is interpreted to have relation to the Belt and Road Initiative (BRI) of China. Kazakhstan and Turkmenistan both have directed their pipelines towards China or Eastbound in general due to impasse at East-West pipeline in Caspian Sea caused by Russian objections. Russia does not want to lose its influence over CIS countries to China, so it might be more lenient towards East-West pipelines for the sake of decreasing Chinese influence in these countries (Kramer, 2018).

In case Caspian waters are accepted as a sea, the UN Convention on the Law of the Sea UNCLOS would apply, but states other than Russia did not even ratify it (Karbuz, 2016). In short, the agreement on August 12th, 2018 does not state the Caspian as a lake or sea firmly. On the surface, it is treated as international water, on the seabed, it is divided into territorial zones, resembling more of lake-like approach (Indeo, 2018).

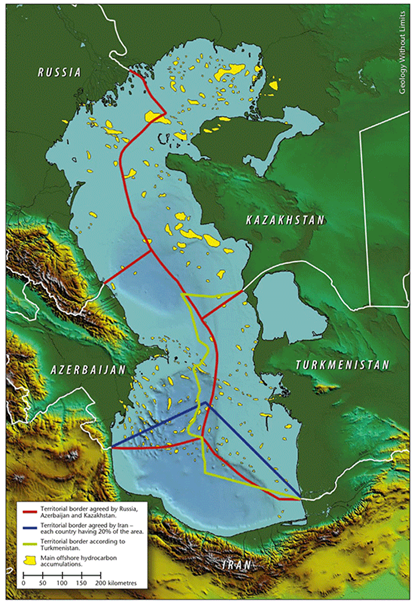

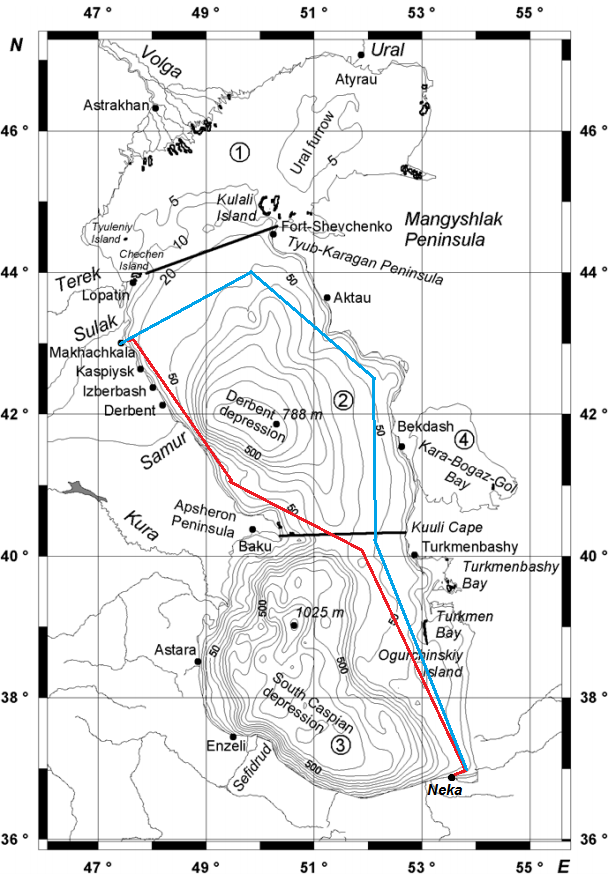

Figure 1 - Division of Caspian Sea based on arguments of five states

Source: Petrov & Amelin, 2015

Figure 1 shows about the various divisions of five Caspian countries. Blue lines denote Iran’s desire, yellow denotes Turkmenistan’s and red is the territorial borders agreed by Azerbaijan, Kazakhstan and Russia. Especially Iran and Turkmenistan have their own claims over the region. Considering it as a lake especially aggravates the disputes, as equal division divides the sea region extremely different from division by coastline (which is seen as a fairer distribution by many countries in the region) (Karbuz, 2016).

Oil and Natural Gas Outlook in Caspian Region

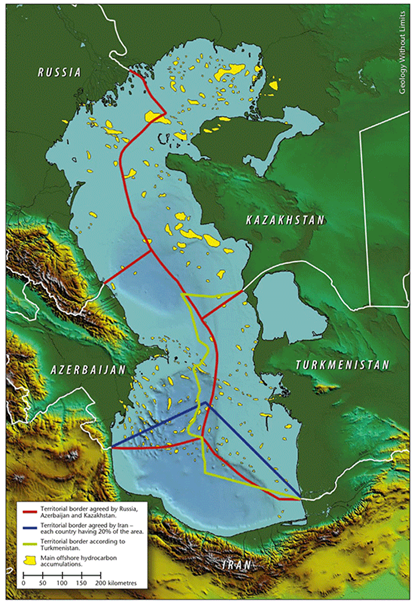

Figure 2 - Oil and Gas Reserves in Caspian and Middle East Region

Source: Shwarz, 2016

Figure 2 shows the oil and gas reserves in the Caspian Region clearly. As seen, the reserves in Caspian Sea are immense, even comparable to Middle East Region, but unexploited until this time due to disputes. Kazakhstan and Turkmenistan have large offshore oil reserves, and Azerbaijan have large offshore natural gas reserves.

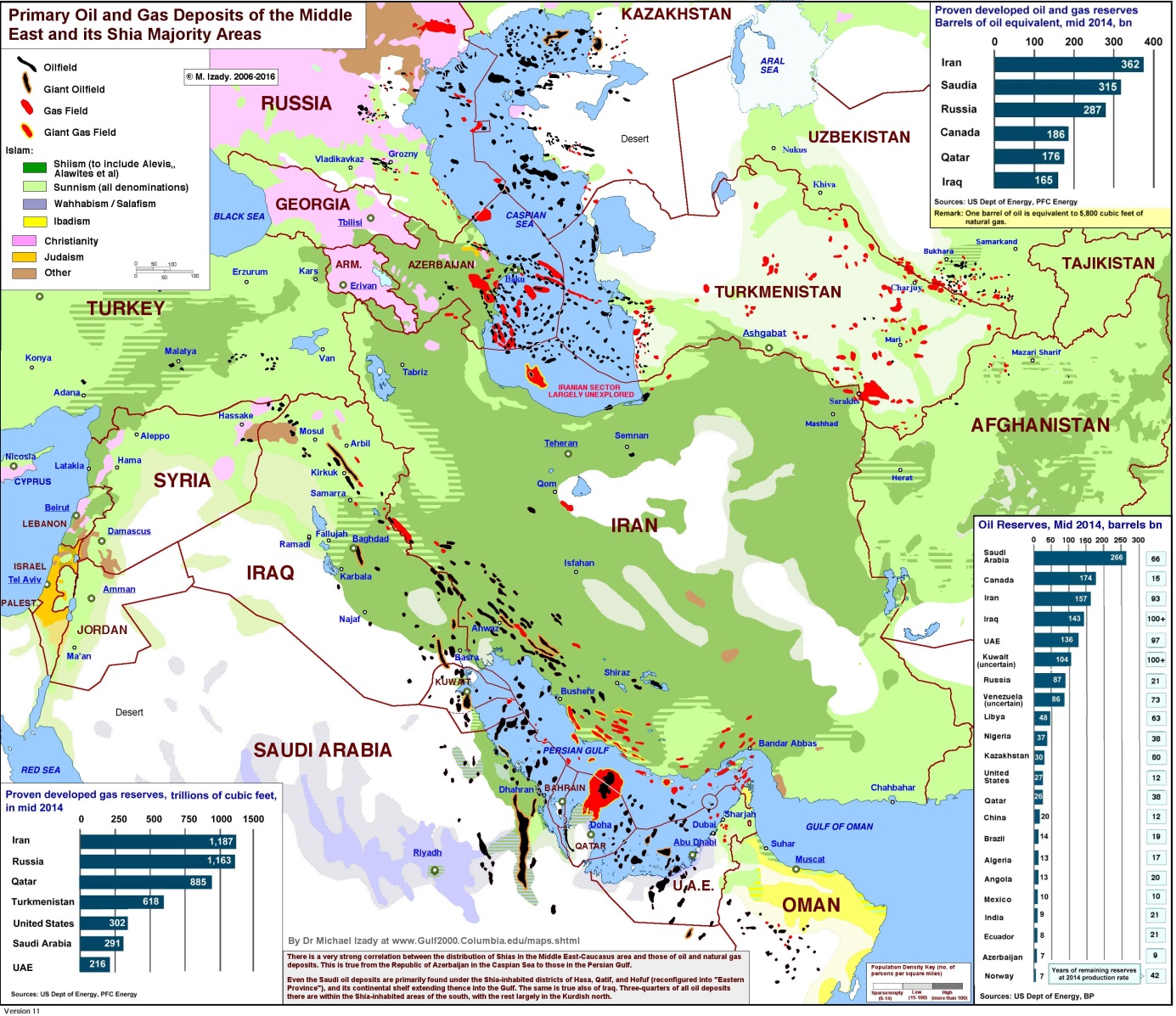

Crude oil specifications change from geographic location to another. However, there are main properties that distinguish the quality of oil from another. These are, API Gravity, sulfur content and viscosity. API Gravity is a measurement that is closely related to the compounds density. If the API of oil is below 20, it is classified as heavy oil. If it is higher, it is light oil. Sulfur in crude oil doesn’t yield high value end products when refined and is classified as contaminant. Moreover, it is a major contributor to air pollution, and it is corrosive. Therefore, refineries and pipelines that carry/process oils with higher sulfur content require much more frequent maintenance, and even some of them might be unable to process high sulfur content oils for this reason (Petroleum.co.uk, 2018). If the percentage of sulfur in a crude oil is below 1%, it is sweet oil. If not, it is sour oil. Viscosity determines how much a fluid resists flowing. Thus, if it has high viscosity and resists flowing, it makes things much harder in pipelines or refineries, making transportation more difficult (Petroleum.co.uk, 2018). In refineries, crude oil is distilled to produce variety of products. Products in upper rows in Figure 3 have lower boiling point, lower density and are more valued (Sunshine, 2018). This means that, if the crude oil that is refined has high density (low API), yields more of the heavier products as seen in Figure 3. In order to obtain high valued lighter products, the heavy crude oil needs to be processed much more with sophisticated techniques (U.S. Energy Information Administration, 2018). Also, most of the time sulfur as a contaminant has to be removed, which needs again, sophisticated techniques (Petroleum, 2018). In addition, high viscosity oils need to be put through dilution process to be carried by pipelines and refineries. Thus, the energy returned on energy invested (EROEI) ratio of sour and heavy oils is lower than EROEI of sweet and light oils (Petroleum.co.uk, 2018).

Figure 3 - Crude Oil Distillation

Source: EIA, 2018

Thus, the main objective of blending oils is to optimize these parameters for the specific purpose. For example, the reason might be to meet sulphur limits of pipelines, environmental laws. It might be to be able to market poor quality un-transportable crude by optimizing viscosity (Cameron, 2012). It might be to meet benchmarks and certain price points. This means that sweet light oil is always preferred, but since they make up only 30% of world’s reserves, they are generally used together with sour heavy oils(Petroleum.co.uk, 2018). In addition, the cost decrease between heavy and light blends sometimes offset the cost of producing light blends.

Currently, there are various techniques for mixing oils. However, the idea of it is relatively simple. The properties of a blend are determined by the weighted average of the properties of the initial oils with respect to their mass ratio in the blend (Cameron, 2018). For example with 50 – 50 mass ratio of Iranian Heavy and Iranian Light, we get,

Table 2 - Result of Blending Iranian Heavy and Iranian Light

|

Important Oil Metrics |

Iranian Heavy |

Iranian Light |

Formed Blend’s Properties |

|

% mass in Mixture |

50 |

50 |

- |

|

Density at 15°C (kg/m3) (Correlated with API) |

879 |

857 |

867.86 |

|

Sulphur (% mass) |

2.24 |

1.46 |

1.85 |

|

Viscosity at 10°C (cSt) |

30.53 |

19.50 |

24.24 |

Source: Cameron, 2018

In short, when a blend is created, it is done by mixing high quality crude oil with low quality oil. The exact properties of the end result are determined by changing the ratio of the mixed oils. Moreover, Table 2 indicates that when forming blends, the most important metrics are API gravity (which is related to density), sulphur content and viscosity.

41% of total crude oil reserves of countries in Caspian region come from offshore fields in the Caspian Sea (U.S. Energy Information Administration, 2013).

Compared to total reserves in countries neighboring the Caspian Sea, (Azerbaijan, Iran, Kazakhstan, Russia, Turkmenistan), the total reserves of 48 billion barrels constitute 15.9% of total proven oil reserves in the five countries (U.S. Energy Information Administration, 2013; BP, 2018).

The oil production in Caspian Sea compared to total production in neighboring countries corresponds to 9.83% (Azerbaijan and Turkmenistan statistics are from 2013 report of EIA, as they are the most recent available data. Iran, Russian Kazakhstan statistics are from 2017.) (U.S. Energy Information Administration, 2013, 2018; OPEC, 2018).

Table 3 - The share of crude oil production in Caspian Region 2012/2017

|

Countries |

Crude Oil Production in Caspian (mb/d) |

Crude Oil Production (mb/d) |

Share |

|

Azerbaijan |

882 |

882 |

100% |

|

Iran |

Negligible |

3867 |

~0% |

|

Kazakhstan |

502 |

1467 |

30.17% |

|

Russia |

41 |

10349 |

0.38% |

|

Turkmenistan |

225 |

225 |

100% |

|

Total |

1650 |

16790 |

9.83% |

Sources: EIA, 2013, 2018; OPEC, 2018

Notable observations are, Iran’s oil production from Caspian Sea is negligible. Same is true for Russia. On the other hand, majority of Azerbaijan and Kazakhstan oil production originates from the Caspian Sea. Also, Turkmenistan does not have the infrastructure for exploiting its oil reserves at all. The only international oil pipeline Turkmenistan has is between Seidi refinery in Turkmenistan and Shymkent refinery in Kazakhstan via Uzbekistan (U.S. Energy Information Administration, 2018).

Table 4 – The share of oil and gas exports of Caspian countries 2016 (USD)

|

Countries |

Total Crude Oil Exports |

Total Gas Exports |

Total Exports |

Share of oil |

Share of gas |

|

Azerbaijan |

$9.35B |

$1.09B |

$12.3B |

76.3% |

8.9% |

|

Iran |

$25.7B |

$104M |

$40.6B |

63% |

0.27% |

|

Kazakhstan |

$13.2B |

$1.35B |

$32.8B |

40% |

4.12% |

|

Russia |

$75.7B |

$11.3B |

$269B |

28% |

4.2% |

|

Turkmenistan |

$484M |

$5.26B |

$7.06B |

6.9% |

74.5% |

Source: The Observatory of Economic Complexity, 2018

Table 5 - Total oil production and export quantity of Caspian countries 2017 in mb/d

|

Countries |

Crude Oil Exports (mb/d) |

Crude Oil Production (mb/d) |

Share |

|

Azerbaijan |

615.3 |

729 |

84.4% |

|

Iran |

2125 |

3867 |

54.95% |

|

Kazakhstan |

1371 |

1467 |

93.45% |

|

Russia |

5062 |

10349 |

48.9% |

|

Turkmenistan |

38.7 |

181 |

21.38% |

Source: OPEC, 2018; Federal Reserve Bank of St. Louis, 2018

For natural gas, 36% of natural gas reserves of the Caspian countries are located in offshore fields in Caspian Sea. This corresponds to 292 trillion cubic feet (Tcf) of proved natural gas reserves. Surveys indicate that there is another 243 Tcf of natural gas yet undiscovered.

Iranian Oil Metrics and Blends

Table 6 depicts the metrics of Iranian oil with respect to National Iranion Oil Company (NIOC) values. For reference, Brent, the international benchmark for oil, reached around $70 on Jan 9th, 2018 for reference (Financial Tribune, 2018).

Table 6 - Iranian Oil Grades and Types

|

Type of Oil |

Typical API Gravity |

Typical Sulphur (%) |

Share of Production (%) |

Inferred Export Quantity (bpd) |

Price (peak on Jan, 9th, 2018) |

|

Forozan |

30.4 |

2.21 |

- |

160 |

- |

|

Iranian Heavy |

29.6 |

2.24 |

45 |

1250 |

$64.11 |

|

Iranian Light |

33.6 |

1.46 |

35 |

450 |

$66.01 |

|

Koroosh |

20.0 |

3.08 |

- |

- |

- |

|

Lavan |

35.4 |

1.67 |

2.97 |

140 |

- |

|

Pars |

22.4 |

4.25 |

- |

- |

- |

|

Sirri |

33.0 |

1.83 |

- |

80 |

- |

|

Sooroosh |

18.9 |

3.88 |

- |

90 |

- |

Source: Financial Tribune, 2018; EIA, 2015; NIOC, 2018

Iranian Heavy is classified as medium (crude oil that has API between 22.3 and 31.1), sour (crude oil that has more than 1% sulphur) crude oil and is sourced from some of Iran’s largest oil fields, named Gachasaran, Marun, Ahwaz and Bangestan (Petroleum.co.uk, 2018; Brittanica, 2018).

Iranian Light, a light (crude oil that has API higher than 31.1), sour on the other hand comes from several fields that are decades old and have large decline rates, such as Ahwaz, Karanj and Aghajari (Petroleum.co.uk, 2018; EIA, 2018). Sustaining the production in these fields long term require Enhanced Oil Recovery techniques that are quite costly (EIA, 2018; Rigzone.com, 2018). In other words, production of Iranian Oil is projected to either decrease, or to become costlier. The exact reserve/quantity of a blend is not really defined, as it comes from different fields. Therefore, the only statement that can be made is, the fields that Iranian Light comes from have declining reserves and production rates in a rapid pace.

Iranian Oil Blends and Their Usage

As stated in section 2.1, the mixing is done by mixing a quality improver (sweet and light oil) with a quality degrader (sour and heavy oil) and the end products properties are determined by ratio of the mixed oils. This means that, there are no inherent limitations to usage of Iranian oil, other than whether it will be used as quality improver or degrader. Iranian blends are, Foroozan Blend, Iranian Heavy Blend, Iranian Light Blend, Lavan Blend and Sirri Blend as given in table 6 (U.S. Energy Information Administration, 2018). However, as Iran exports its oil via shipping, there is no lower limit (low API, high viscosity limit) to the viscosity or API compared to how it otherwise would have been with pipelines. There is an upper limit, but as Iranian oils are not ultra-light, this does not appear to be an issue. Thus, the importers of Iranian oil process and blend the oil with an oil of their choice in the refineries of their own country, if it is necessary (U.S. Energy Information Administration, 2018). This means that the commercially sold Iranian blends are those which are formed by Iran. However, oil of Iranian origin can get blended with other oils, but this is done domestically by importers, of which there is not a given name.

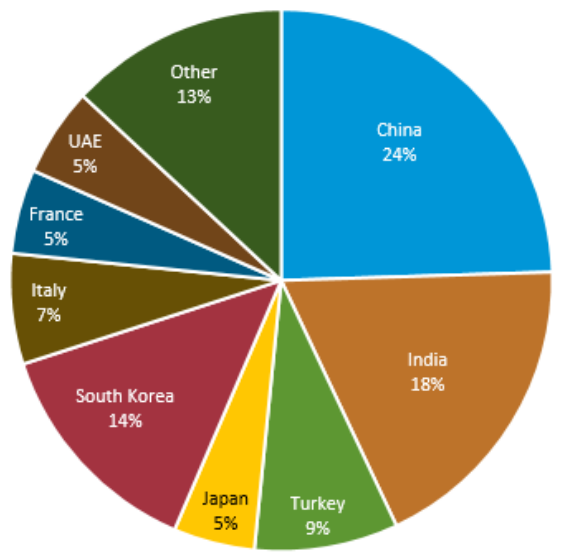

If one still asks which blends Iranian oil might be part of, one has to look for export destinations of Iranian crude oil. Figure 4 shows the countries that have higher chance of using Iranian oil in their domestic blends.

Figure 4 - Iran Crude Oil Exports by destination

Source: EIA, 2018

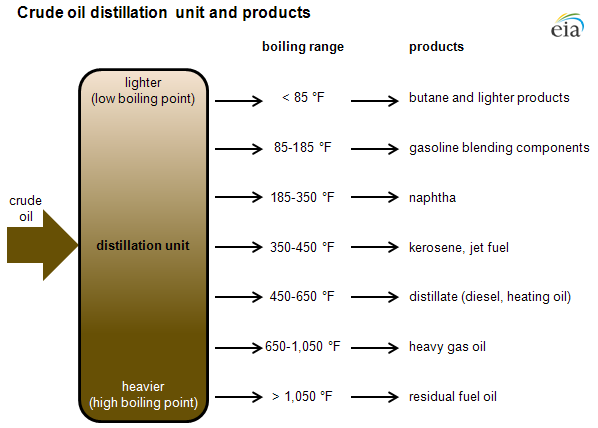

Moreover, as Iranian Light is not ultra light, it contains relatively higher proportion of mid distillates compared to other light crudes from around the globe. Current estimations project that, mid-distillate products such as jet fuel and diesel demands will increase in the upcoming years (Bloomberg, 2018). The mid-distillates have lower proportion in lighter crudes. Therefore, this seems promising for the future value of Iranian crudes.

Table 7 - Russian Oil Blends' Metrics

|

Type of Oil Blends |

Typical API Gravity |

Typical Sulphur (%) |

Destination |

|

Urals |

31 |

1,4 |

Europe |

|

Sokol |

35.5 |

0,28 |

India |

|

Sakhalin |

37.3 |

0,16 |

Japan, India |

|

ESPO |

34.8 |

0,47 |

China |

|

Varandey |

37.8 |

0,42 |

- |

|

ARCO |

24 |

2,3 |

Europe |

|

Novy Port |

30-35 |

0,1 |

Europe |

Source: Financial Tribune, 2018; EIA, 2017; NIOC, 2018

Figure 5 - Russian Oil Extraction Zones

Source: EIA, 2014

Urals Blend given in Table 7 is the main export blend of Russia. It is used to supply oil to China and Europe. As indicated in table 7, Urals blend is medium gravity (around API of 31), sour (around 1.4% sulfur content). It is therefore, a mixture of lighter and sweeter crude oil and heavier and sourer crude oil. The sweet and light crude oil in the Urals Blend comes from West-Siberia region. The sour and heavy crude oil in the Urals Blend comes from Urals-Volga region. As indicated in Figure 5, 62% of crude oil production originates in West-Siberia region and 22% originates in Urals-Volga region. These highly produced crude oils coming from 2 different regions are blended to form the main export blend, Urals Blend in high quantities (Metelitsa & Albanese, 2014).

Both Urals-Volga and West-Siberia regions cover a significant amount of geographical area. Thus, within these regions, the quality of oil is not extremely clear cut, it varies. Moreover, since the oil extracted from these regions is not exported directly, their API Gravity values and sulfur content values are not available. Instead, the blend that is formed is exported, and thus blend’s API Gravity and sulfur content values are known. However, a rough estimate can be made on the quality of oil extracted from Urals-Volga and West Siberia region. Crude oil extracted from Urals-Volga is heavy and sour. This puts crude from Urals-Volga region at API Gravity less than 25 and sulfur content higher than 1.8% (Ricker, Barron & Hamilton, 2017; Soldatkin, 2018). The crude extracted from West Siberia region is then put at API Gravity higher than 35 and sulfur content less than 1% (Metelitsa & Albanese, 2014; U.S. Energy Information Administration, 2017).

ESPO Pipeline Details

Eastern Siberia Pacific Ocean (ESPO) oil pipeline exports crude oil from Russia to the Asian Pacific markets of China, Japan and Korea. This oil pipeline is a 4,188 km-long system.

The first ESPO pipeline branch starts flow from Mohe at Russian border to the Chinese city of Daqing. Since 2011, Russia sent 15 million tons a year of its crude oil to China. The second oil pipeline was built in parallel with the first line between Mohe and Daqing (Verma, 2018). From 1st January, 2018, this second line increased Russia crude oil export capacity from 15 million tons to 30 million tons (600kbd) annually according to Xinhua reports (Verma, 2018).

Turkmenistan has the 4th largest natural gas reserves in the world but it ranks 11th in terms of natural gas production, as it greatly lacks the infrastructure needed for production and exporting (BP, 2018). For this reason, it relied heavily on its neighbor countries, Russia, Iran in early 2010s for income. For perspective, 62.7% of Turkmenistan’s gas export’s destination was Russia in 2008, with a quantity of 35 billion cubic meters (bcm). This fell to 10 bcm by 2015, corresponding to 24.81% of Turkmenistan’s gas exports. Similarly, Turkmenistan had a deal of 6-8 bcm/year with Iran that continued for years, corresponding roughly to 13.3 – 26.75% of Turkmenistan’s gas exports. Both Russia and Iran stopped importing gas from Turkmenistan in 2015 and 2017 respectively, bumping China’s share as the gas export destination from around 65% to 80% (OPEC, 2018). The Central Asia-China Pipeline (CACP) has been the main pathway for the exports from Turkmenistan to China (BP, 2018; U.S. Energy Information Administration, 2018; Pirani, 2018). Moreover, China started to use the loan it gave to Turkmenistan for developing gas fields in Galkynysh to lower the price of the imported gas (Pirani, 2018). With Iran and Russia gone, and Turkmenistan only option, China playing “not so cleanly”, Turkmenistan’s economy started to deteriorate as seen in Table 8 (Pirani, 2018). Furthermore, Russia’s Power of Siberia pipeline will start supplying gas to China by early 2020 (AzerNews, 2018). Also, China has been investing in LNG handling facilities and upping its imports from Qatar, the US and Australia (AzerNews, 2018). In the future, when increased competition awaits Turkmenistan, diversifying its own options is a great strategy. As Russia and Iran were blocking any possible pipeline from the Caspian Sea for decades, Turkmenistan came up with Turkmenistan-Afghan-Pakistan-India (TAPI) pipeline, but it is plagued by dealings with Taliban and Turkmenistan bearing 85% of the project’s total cost with a very small economy (Pirani, 2018). This means that Trans-Caspian Pipeline (TCP) can be the viable solution for Turkmenistan if the disputes are resolved. It has already built an East-West pipeline system in 2015, connecting its gas fields in East to the Caspian Sea (U.S. Energy Information Administration, 2018). Through Azerbaijan and TANAP, there is already an existing pathway for Turkmenistan gas as seen in Figure 6 (Pirani, 2018).

Figure 6 - Natural Gas Pipelines in Caspian Region excluding Iran

Source: U.S. Energy Information Administration, 2018

Europe and Turkey are possible customers, and both of them want to diversify their energy import portfolio, to decrease their dependence on Russia. Europe itself was pushing for Trans Caspian pipeline and a southern corridor since 1990s (Pirani, 2018). In 1990s, Turkmenistan’s discovered gas reserves were 2.6 trillion cubic meters (tcm). By 2017, this has increased to 19.6 tcm (BP, 2018). Knowing long term payoffs of a potential TCP is higher for the Europe, The EU adopted a mandate in 2011 to negotiate a legally binding treaty between European Union (EU), Azerbaijan and Turkmenistan (AzerNews, 2018). Moreover, the gas prices from Turkmenistan especially to Turkey and Southeast Europe are projected to be competitive against Russian prices (Pirani, 2018). Considering all these together, Turkmenistan can benefit greatly from resolving disputes and constructing TCP. With that, it can pick up its slowing economy, end its reliance on China, increase its customers, and find European partners that are more likely to invest in its vast natural gas reserves.

Table 8 - Turkmenistan's foreign trade, in US dollar billion

|

$ billion |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

Exports |

9.7 |

16.8 |

20 |

18.9 |

19.8 |

12.2 |

7.2 |

7.8 |

|

Imports |

8.2 |

11.4 |

14.1 |

16.1 |

16.6 |

14.1 |

13.2 |

10.2 |

|

Balance |

1.5 |

5.4 |

5.8 |

2.8 |

3.1 |

-1.9 |

-6.0 |

-2.4 |

Source: Pirani, 2018

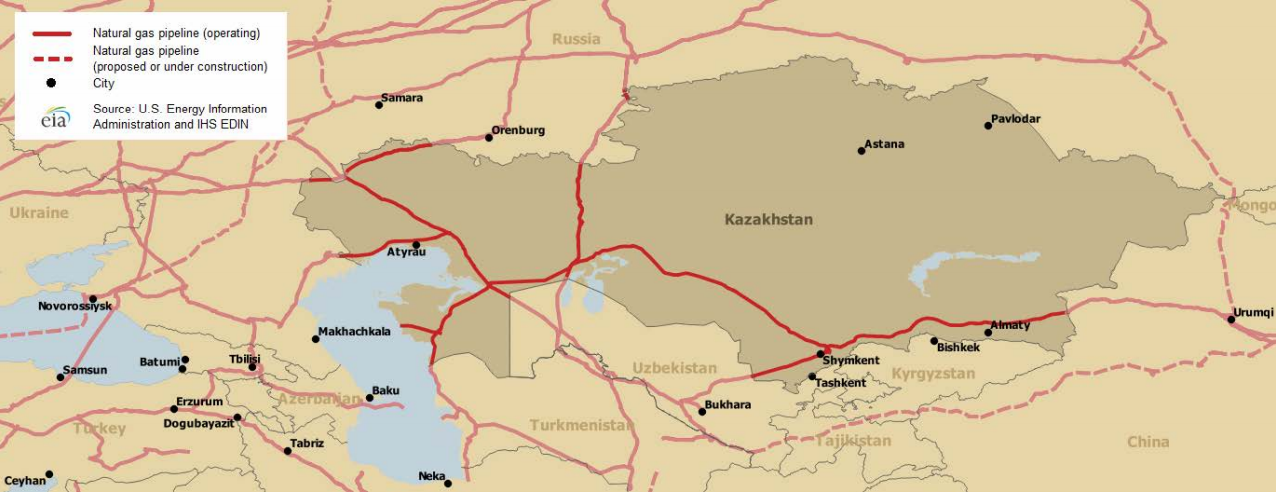

Kazakhstan’s major energy export is oil. Due to disputes over Caspian Sea, it connected its export routes to two countries, China and Russia. Main export routes for Kazakhstan oil are Caspian Pipeline Consortium (CPC) to Russia’s Novorossiysk, Kazakhstan-China pipeline, and the Uzen-Atyrau-Samara pipeline to Russia as seen in Figure 7 (U.S. Energy Information Administration, 2018).

Figure 7 - Oil pipelines in Caspian Region excluding Iran

Source: U.S. Energy Information Administration, 2018

Similar to Turkmenistan, Kazakhstan depends greatly on pipeline deals with Russia and China. Utilizing a Trans Caspian Oil Pipeline to Azerbaijan then to BTC would greatly increase Kazakhstan’s option in many ways. For example, CPC was developed by Russia to compete against BTC. Therefore, diversifying towards Azerbaijan not only opens up increased trade volume from that route, but also gives leverage to Kazakhstan against Russia. BTC has capacity for Kazakhstan oil, as it operates at just two-thirds of capacity (Coleman, 2018). Moreover, BTC avoids the traffic in Bosporus and Black Sea and value reducing shipments through China or Russia (Coleman, 2018). In short, an oil pipeline to BTC potentially increases the trade volume of Kazakhstan, increases the profit it makes from oil trade, gives leverage against its existing trade partners and reduces trade risks by diversification.

Azerbaijan already supplies gas and oil from the Southern corridor (U.S. Energy Information Administration, 2018). However, the volume of it has left much to be desired (Pirani, 2018) (Coleman, 2018). If the disputes are resolved, Azerbaijan can become a key transit hub for oil and gas due to increased trade volume from Kazakhstan and Turkmenistan, both of which are projected to be major oil, gas suppliers respectively in the future (Aliyeva, 2018). This boosts its geopolitical importance immensely and gives it leverage in its dealings with Russia, Iran, Europe and others.

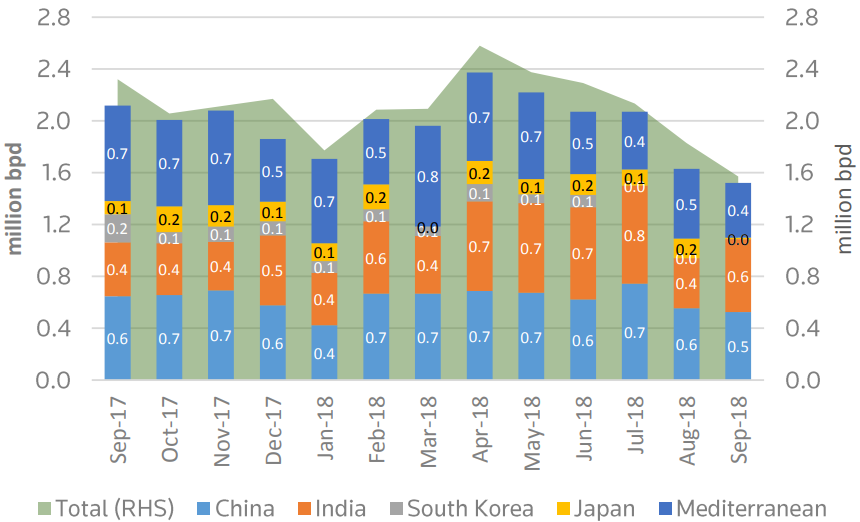

Iran is a major player in the energy market, ranking 4th in oil reserves and 2nd in gas reserves in the world (BP, 2018). However, due to political clashes with the US, Iran is having issues translating its existing infrastructure to profit (Beevor, 2018). After lifting the sanctions against Iran in 2015, the US is again threatening Iran with serious sanctions. The sanctions ban any transactions with Iran involving US dollar, gold or other precious metals (Harris & Ewing, 2018). Moreover, the US is trying to get SWIFT system to exclude Iran from using it. In 2012, SWIFT transactions from Iran were blocked. Compared to $92.5 billion revenues from oil exports in 2011, the revenue fell to $52 billion in 2012, after the sanctions (Beevor, 2018). The effects of the SWIFT ban are still reflected on Iran’s export revenue, which sits at $25.7 billion in 2016 as seen in

4. Moreover, the most recent sanction threats have already affected Iran’s exports as seen in Figure 8. While the crude oil exports of Iran were 3.8 mb/d in 2017, it has decreased to approximately 1.7 mb/d by September 2018 (Bloomberg, 2018).

Figure 8 - Iran crude oil exports (mmb/d)

Source: Eikon, 2018

Major implication of resolution of Caspian disputes is that, Iran can use a potential pipeline project in Caspian to evade the sanctions. Iran is already doing so with China by dealing in local currencies, as their trades are relatively balanced with the help of Iran’s oil shipments as seen in Tables 12 and 13. However, by utilizing a pipeline to Russia, Russia can mix Iranian oil and distribute it to Europe, Turkey or other countries via Novorossiysk port. Russia is the most likely candidate, as they have outspokenly stated that they are heavily against the US sanctions (Beevor, 2018). Moreover, Russia even stated that, they are willing to purchase Iranian oil in exchange for increased purchases of Russian goods and services (Foy, 2018). The trade scheme shows that, if Russia decides to buy more oil from Iran, their trade can be balanced, making dealing with local currencies a possibility as seen in Tables 10 and 11 In short, Caspian poses a great potential for Iran to evade the US sanctions and as a backdoor for its oil and gas trade. With such a route, it can increase its export volume as well.

Russia has been trying its best to keep Kazakhstan and Turkmenistan out of the competition in European markets. However, it has realized that this might not be the best option for itself in the long run (Kramer, 2018). In response to the constant blockage coming from Russia, both Turkmenistan and Kazakhstan have gravitated towards Chinese sphere of influence. Politically, resolving disputes in Caspian Sea can bring Kazakhstan and Turkmenistan closer to Western scene away from China’s BRI, thus closer to Russia (Kramer, 2018). In addition, Russia is especially weary of possible terrorist spillage closer to its border. For this reason, if Turkmenistan and Kazakhstan are better off economically, a potential Islamist insurgency spilling over from Afghanistan can be prevented more easily (Pirani, 2018). Moreover, a potential pipeline with Iran can let Russia deal Iranian oil and collecting revenue from it. Also, by helping Iran evade the US sanctions, Russia gets a political leverage against the US in its diplomatic dealings. This might be especially beneficial for Russia, as it is currently negotiating with the US quite a lot over Middle East disputes (Crooks, 2018). In summary, by opening up the East-West corridor, it can bring CIS countries away from China, secure its borders against terrorism and by brokering a trade deal with Iran, it can gain economic benefits and diplomatic leverage against US.

Potential damages for Russia and Iran

From the Russian point of view, the Caspian Region has some apprehensions because of its high potential and strategic location. Other border countries may conflict with Russia’s interests.

Russia and Iran have always opposed the Trans-Caspian oil and gas line projects, although a lot of pipelines have been installed in the Caspian. Thus, they blocked the competition as much as possible. Russia is trying to keep the Caspian region under its control because Russia may face the risk of losing its own oil and gas market when the Caspian’s resources are reached by providing economic opportunities. Russia is using all its power in this region and is still trying to keep Caspian’s border countries under its control. Actually, the main reason of Russia is based on past events, when it was understood that the oil production of the Russian Federation began to decline after 1991, the proven oil reserves of 10 bbl in the Caspian Sea in the north triggered Russia's interest in marine resources at the expense of geopolitical concerns

“Generally, Russia’s initial inability to reconcile all its interests was largely due to the lack of consensus on foreign-policy priorities among Russian political elites, the inability of the government to oversee and coordinate policies pursued by different agencies, and the growing power of economic lobbies. Its desire to preserve the exclusive character of its influence, its “informal empire” in the Caspian region, opposed any external involvement into the region. Thus, the first decade for Russia brought no progress in negotiating a new legal regime and defining the status of the Caspian. Contributing factors were the internal turmoil within the country fueled by chaotic privatization, the lack in expertise in the Foreign Ministry, and the Caspian states’ eagerness to decrease their dependence on the federation. Additionally, the conflict in Chechnya hampered political and economic reforms and negatively affected the stability of Russia itself. By the end of Yeltsin’s term, Russia’s position in the Caspian was weak and full of contradictions. Even Iran deemed the federation as an important but unreliable ally” (Zimnitskaya & Geldern, 2010).

However, since Iran does not intend to compete with Russia in the European gas market, Iran is facing the potential markets in the East, namely Pakistan and India. Iran wants that Turkmen gas would go Pakistan or India through its own territory. Therefore, Iran does not want to the TAPI (Turkmenistan-Afghanistan-Pakistan-India) gas pipeline project supported by Russia to take place. Even if Russia confirms Iran’s request, it is unclear what the US’ position on Afghanistan will be. According to present situation of Afghanistan, this does not seem to be feasible plan.

Potential damages for Turkmenistan

In 2016, the flow of Turkmen gas to Russia stopped because of disagreements between Turkmenistan and Russia. A year later, Iran's gas flow was interrupted. That is, Turkmenistan's annual total of 50 billion cubic meters of natural gas trade stopped (Karbuz, 2018). Aside from its gas swap agreements with Iran, the only important customer left: China. In this case, Turkmenistan is warmly welcomed to take its gas to Europe. However, the latest agreement in 2018 includes an item which is article 15 states certain conditions: As stated in previous agreements and protocols, it will comply with environmental standards in international norms and will not harm the environment and ecological system (Convention on the Legal Status of the Caspian Sea, 2018). In other words, it is not possible to veto the pipelines, but it seems that they will be able to remove any difficulties on the grounds that they can create a potential risk for the Caspian Sea. In addition, it is also necessary to question how the attitude of Russia and Iran would be to the Turkmen gas going to Europe. Russia probably would not welcome Turkmen gas in the European market against itself without an ulterior motive. Russia may possibly buy Turkmen gas and re-export it.

Conclusion for damages

“Yet to allow ourselves one more final paradox, this situation has worked to the advantage of the small states, Azerbaijan and Kazakhstan, to the hindrance of the Russian Federation, and to the distinct disadvantage of Iran.

Azerbaijan, which initially insisted that the Caspian waters is a sea that must function under the UNCLOS, has profited by the Caspian’s uncertain status as a lake on its surface, and a sea beneath. Russia has achieved some of its goals, foremost control of the surface waters, through this status, and it is rushing to catch up to Azerbaijan in its capacity to exploit petroleum resources. Iran, which insists that the Caspian is a lake which must be divided according to terms of the Soviet–Iran Treaties, finds itself excluded from both the seabed resources and most of the surface by the legal vacuum created by its intransigence. Yet ultimately, until the Caspian is brought fully under the umbrella of the international rule of law, these outcomes will remain imperiled by changing circumstances. Azerbaijan has been able to tap into the rich oil fields that would be part of its EEZ under UNCLOS. It has done so under the protection of its bi-lateral treaties with Russia” (Zimnitskaya and Geldern, 2010, 12).

If the complex paradox formed in the Caspian can be solved, Russia and Iran seem to be the two countries that will suffer the most. If the return of plans of Kazakhstan oil to international markets via the Trans-Caspian oil pipeline project through the Baku-Ceyhan pipeline will again cause major problems for Russia and Iran.

Trade Statistics for Caspian Region

This section outlines the trade statistics for the Caspian Region.

Overall trade balance between Caspian countries

Table 9 - Trade balance between Caspian countries 2017 (US$ Million)

|

Partner Host |

Azerbaijan |

Iran |

Kazakhstan |

Russia |

Turkmenistan |

|

Azerbaijan |

- |

-221.37 |

-71.49 |

-884.4 |

-55.99 |

|

Iran |

296.88 |

- |

101.35 |

-418.77 |

405.19 |

|

Kazakhstan |

72.16 |

416.50 |

- |

-6,957.76 |

10.95 |

|

Russia |

952.81 |

924.16 |

7,324.58 |

- |

258.79 |

|

Turkmenistan |

55.99 |

-405.19 |

-10.95 |

-258.79 |

- |

Source: ITC, 2018

A notable takeaway from table 9 is that, Russia is running a trade surplus against all the Caspian countries. Thus, theoretically Russia has the financial space of increasing its imports from its neighboring countries. Actually, it might be motivated to do so, in order to balance out the trade. This in turn allows the nations to trade in local currencies, if none of the trading partners are bleeding out foreign currency constantly.

Although Azerbaijan’s trade with Kazakhstan and Turkmenistan is relatively balanced, it is still negative. Thus, if Azerbaijan starts importing Turkmenistan gas or Kazakhstan oil from a hypothetical pipeline in Caspian Sea, its trade deficit would increase. This might be potentially undesirable for Azerbaijani economic and political goals.

Table 10 - Russia's exports to Iran by product 2016

|

Host |

Partner |

Product Group |

Export (US$ Million) |

Export Product Share (%) |

|

Russia |

Iran |

All Products |

1,882.8 |

100 |

|

Russia |

Iran |

Capital goods |

652 |

34.65 |

|

Russia |

Iran |

Consumer goods |

46 |

2.42 |

|

Russia |

Iran |

Intermediate goods |

536.2 |

28.49 |

|

Russia |

Iran |

Raw materials |

331.3 |

17.61 |

|

Russia |

Iran |

Animal |

0.067 |

0 |

|

Russia |

Iran |

Chemicals |

20.4 |

1.08 |

|

Russia |

Iran |

Food Products |

5,692.63 |

0.3 |

|

Russia |

Iran |

Footwear |

0.003 |

0 |

|

Russia |

Iran |

Fuels |

1.727 |

0.09 |

|

Russia |

Iran |

Hides and Skins |

0.001 |

0 |

|

Russia |

Iran |

Mach and Elec |

504.8 |

26.82 |

|

Russia |

Iran |

Metals |

282.5 |

15.01 |

|

Russia |

Iran |

Minerals |

0.00019 |

0 |

|

Russia |

Iran |

Miscellaneous |

322.7 |

17.15 |

|

Russia |

Iran |

Plastic |

8.76 |

0.47 |

|

Russia |

Iran |

Stone and Glass |

2.3 |

0.12 |

|

Russia |

Iran |

Textiles |

2.75 |

0.15 |

|

Russia |

Iran |

Transportation |

163.71 |

8.7 |

|

Russia |

Iran |

Vegetable |

422.65 |

22.46 |

|

Russia |

Iran |

Wood |

143.74 |

7.64 |

Source: WITS, 2018

Table 11 - Russia's imports from Iran by product 2016

|

Host |

Partner |

Product Group |

Import (US$ Million) |

Import Product Share (%) |

|

Russia |

Iran |

All Products |

302.55 |

100 |

|

Russia |

Iran |

Capital goods |

9.04 |

2.99 |

|

Russia |

Iran |

Consumer goods |

23.25 |

7.69 |

|

Russia |

Iran |

Intermediate goods |

27.57 |

9.11 |

|

Russia |

Iran |

Raw materials |

217.19 |

71.79 |

|

Russia |

Iran |

Animal |

2.21 |

0.73 |

|

Russia |

Iran |

Chemicals |

12.49 |

4.13 |

|

Russia |

Iran |

Food Products |

15.18 |

5.02 |

|

Russia |

Iran |

Footwear |

0.016 |

0.01 |

|

Russia |

Iran |

Fuels |

0.806 |

0.27 |

|

Russia |

Iran |

Hides and Skins |

0.00095 |

0 |

|

Russia |

Iran |

Mach and Elec |

6.71 |

2.22 |

|

Russia |

Iran |

Metals |

1.11 |

0.37 |

|

Russia |

Iran |

Minerals |

3.02 |

1 |

|

Russia |

Iran |

Miscellaneous |

26.11 |

8.63 |

|

Russia |

Iran |

Plastic |

10.88 |

3.59 |

|

Russia |

Iran |

Stone and Glass |

3.58 |

1.18 |

|

Russia |

Iran |

Textiles |

2.95 |

0.97 |

|

Russia |

Iran |

Transportation |

1.78 |

0.59 |

|

Russia |

Iran |

Vegetable |

215.67 |

71.28 |

|

Russia |

Iran |

Wood |

0.053 |

0.02 |

Source: WITS, 2018

Looking at the data, the Russian Iranian trade is highly imbalanced. However, when only raw material exports are concerned, which encompasses oil exports, one can argue that Russia imports $217 million of raw material while exporting $331 million of it, so there is 65.6% reciprocity in that product group trade. Also, in the case of an agreement in which Iran starts selling its oil to Russia, the Russian imports from Iran would increase and 65.6% reciprocity would increase as well. This means that, the trade imbalance might be much lower, if a Caspian pipeline is constructed so that Iran can sell oil to Russia. In such a scenario, since Iran has very high oil production, it can sell sufficient amount of oil to equalize the trade imbalance (for record, Russia exports $1.88 billion, but imports $0.3 billion, the gap can be closed by a oil deal in Caspian) (WITS, 2018).

Moreover, Russia views a possible trade deal positively. Russian Chamber of Commerce and Industry Vice President Vladimir Padalko said the resumption of US sanctions on Iran will not push away entrepreneurs or disturb interaction with the agreement (Financial Tribune.com, 2018). In addition, Iran and Russia are aiming to exchange Russian weapons with Iranian crude oil because they are trying to avoid from using US dollars, which increase the possibility of a trade deal.

Trade statistics between Iran and China

One thirds of Iran’s oil exports go to China currently. China, is a really important client for Iran (Lee, 2018).

Table 12 - Chinese exports to Iran by product 2016

|

Host |

Partner |

Product Group |

Export (US$ Million) |

Export Product Share (%) |

|

China |

Iran |

All Products |

16,417.27 |

100 |

|

China |

Iran |

Capital goods |

6,214.4 |

37.85 |

|

China |

Iran |

Consumer goods |

5,703.63 |

34.74 |

|

China |

Iran |

Intermediate goods |

4,134.6 |

25.18 |

|

China |

Iran |

Raw materials |

359.4 |

2.19 |

|

China |

Iran |

Animal |

103.75 |

0.63 |

|

China |

Iran |

Chemicals |

917.95 |

5.59 |

|

China |

Iran |

Food Products |

80.49 |

0.49 |

|

China |

Iran |

Footwear |

230.47 |

1.4 |

|

China |

Iran |

Fuels |

53.43 |

0.33 |

|

China |

Iran |

Hides and Skins |

117.15 |

0.71 |

|

China |

Iran |

Mach and Elec |

5,436.23 |

33.11 |

|

China |

Iran |

Metals |

1,984.49 |

12.09 |

|

China |

Iran |

Minerals |

26.2 |

0.16 |

|

China |

Iran |

Miscellaneous |

1,221.88 |

7.44 |

|

China |

Iran |

Plastic or Rubber |

926.77 |

5.65 |

|

China |

Iran |

Stone and Glass |

545.21 |

3.32 |

|

China |

Iran |

Textiles and Clothing |

1,692.49 |

10.31 |

|

China |

Iran |

Transportation |

2,315.52 |

14.1 |

|

China |

Iran |

Vegetable |

231.95 |

1.41 |

|

China |

Iran |

Wood |

533.31 |

3.25 |

Source: WITS, 2018

Table 13 - Chinese imports from Iran by product 2016

|

Host |

Partner |

Product Group |

Import (US$ million) |

Import Product Share (%) |

|

China |

Iran |

All Products |

14,827.19 |

100 |

|

China |

Iran |

Capital goods |

6.1 |

0.04 |

|

China |

Iran |

Consumer goods |

197.14 |

1.33 |

|

China |

Iran |

Intermediate goods |

3,485.55 |

23.51 |

|

China |

Iran |

Raw materials |

11,138.26 |

75.12 |

|

China |

Iran |

Animal |

0.628 |

0 |

|

China |

Iran |

Chemicals |

1,154.81 |

7.79 |

|

China |

Iran |

Food Products |

0.875 |

0.01 |

|

China |

Iran |

Footwear |

0.002 |

0 |

|

China |

Iran |

Fuels |

9,601.07 |

64.75 |

|

China |

Iran |

Hides and Skins |

0.702 |

0 |

|

China |

Iran |

Mach and Elec |

1.08 |

0.01 |

|

China |

Iran |

Metals |

183.02 |

1.23 |

|

China |

Iran |

Minerals |

1,753.56 |

11.83 |

|

China |

Iran |

Miscellaneous |

0.597 |

0 |

|

China |

Iran |

Plastic or Rubber |

2,094.58 |

14.13 |

|

China |

Iran |

Stone and Glass |

0.824 |

0.01 |

|

China |

Iran |

Textiles and Clothing |

3.71 |

0.03 |

|

China |

Iran |

Transportation |

4.89 |

0.03 |

|

China |

Iran |

Vegetable |

26.4 |

0.18 |

|

China |

Iran |

Wood |

0.446 |

0 |

Source: WITS, 2018

An important takeaway from Table 12 and 13 is that the trade is relatively balanced between China and Iran. Therefore, as their trade is balanced, they can sustain an economic trade relationship in terms of their local currencies (Foy, 2018). But then, Russia would not be happy with a possible pipeline from Iran to Kazakhstan, as Kazakhstan already has existing infrastructure to send gas and oil to China (and as the scope of this research is on Caspian Sea). Also, as Russia is already weary of the influence Chinese BRI exerts on Caucasus, Central Asia, it might try to make a deal to replace China as a possible partner for Iran (Kramer, 2018).

In order to dodge the serious sanction threats from the US, Iran might use Caspian Sea as an exit strategy, and strike a deal with Russia under matching interests.

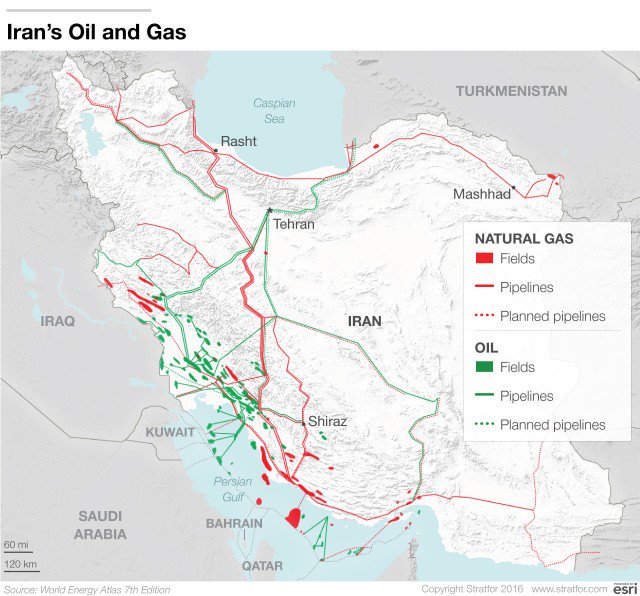

Oil and gas reserves and pipeline infrastructure of Iran

Figure 9 shows the complete outline of Iran’s pipeline infrastructure and oil and gas fields from 2016. Figures 10 and 11 show the most recent pipeline infrastructure of Iran as of April 9th, 2018 (U.S. Energy Information Administration, 2018). All of the discovered oil fields in Iran are located in the Southwestern portion of Iran. 85% of it is located onshore, while remaining 15% is offshore in the Persian Gulf (U.S. Energy Information Administration, 2018). However, the oil is very unevenly distributed in Iran. 71% of total oil reserves are located in a small province in Southwest Iran called Khuzestan (U.S. Energy Information Administration, 2018). Similarly, all of the gas production in Iran comes from Southern Iran. Recently, Iran discovered gas fields in Western Iran and completed the gas pipelines connected to that area (U.S. Energy Information Administration, 2018).

Figure 9 - Iran Oil and Gas reserves and Pipeline Infrastructure

Source: World Energy Atlas, 2016

Figure 10 - Iran Gas Pipelines

Source: EIA, 2018

Figure 11 below shows that, Iran has the oil pipeline infrastructure to carry up to 500,000 barrels per day (bpd) of the Southwest oil up to Caspian Sea. This city of Neka is actually a port that has been used for oil swap agreements in the past with Azebaijan, Kazakhstan and Turkmenistan (U.S. Energy Information Administration, 2018). The oil coming from those three countries were used to feed northern Iran the oil that is required (Kurtmulayev, 2012). Moreover, in 2017, Iran made a deal with Russia to import their oil from Neka port, meaning that the port is capable of handling oil trade (Theiranproject.com, 2017). In 2016, with the IOTC’s investments, Neka port has been expanded to have 13 oil tanker docks, capable of berthing ships up to 63 thousand tons (ITE Transport & Logistics, 2016). Moreover, the pipeline to Neka is capable of carrying 500,000 bpd, which corresponds to approximately 25% of Iran’s total oil exports per day, as seen from the data in Table 3 (Aliyeva, 2017). Moreover, Neka port terminal has a loading capacity of 1.5 million bpd (ITE Transport & Logistics, 2016). Moreover, the oil storage capacity of Neka port is 250 million liters, and only 10% of it is being used as of 2017 (Financial Tribune, 2017).

Figure 11 - Iran Oil Pipelines

Source: EIA, 2018

Details of Iran Pipelines

Natural Gas Pipelines

Iran- Pakistan natural gas pipeline project: Iran was trying to expand its trade path for China with the help of the construction of Iran-Pakistan gas pipeline. This pipeline project is also important for Pakistan to supply its energy needs.

The project, previously known as the Peace Pipeline, was firstly proposed in the 1990s and included a 600km extension into India (Hydrocarbons Technology, 2014).

“Since the pipeline route passes through conflicted areas such as Baluchistan, India withdrew from the project in 2009, citing concerns with gas pricing and security of the pipeline. Pressure from the US was also considered as one of the reasons for India’s withdrawal” (Hydrocarbons Technology, 2014).

The US government was trying to isolate Iran economically. Despite sanctions from the US, Pakistan decided to build the pipeline because of its energy problems.

“In June 2010, Pakistan and Iran signed an agreement to go ahead with the project. The agreement was signed between the Iranian Gas Export Company and Pakistan’s Inter State Gas Systems (ISGS). According to the agreement, Iran will supply gas to Pakistan for a period of 20 years with a five-year grace period” (Hydrocarbons Technology, 2014).

Iranian government completed construction of the pipeline on its side of the project.

“It was reported during late months of 2016 that Pakistan has put an end to the pipeline project owing to political pressure from a Gulf country” (ETEnergyworld.com, 2018).

The Iran Gas Trunkline (IGAT):

It is a series of large diameter pipelines constructed from gas refineries in the south of Iran (Khuzestan and Bushehr provinces) in order to transfer natural gas to consumption centers across the country (Pars Oil and Gas Company, 2018).

The Dauletabad–Sarakhs–Khangiran natural gas pipeline:

It (also known as Dauletabad–Salyp Yar pipeline) is a natural gas pipeline from the Dauletabad gas field in Turkmenistan to Khangiran in Iran, where it is connected with the Iran Gas Trunkline system. It is significant as it allows the diversification of Turkmenistan's gas export routes, doubling the nation's export of gas to Iran. For Iran, the pipeline allows the country to deal with gas shortages in its northern regions, and to improve its reputation as a trade partner in the Caspian region (Parkhomchik, Simsek & Nurbayev, 2016).

Iran- Armenia natural gas pipeline: “The Iran–Armenia gas pipeline runs from Tabriz to the Iran–Armenia border. The Armenian section runs from the Meghri region to Kajaran, and another 197 kilometers (122 miles) of pipeline is planned to reach the center of the country, where it will link up with the existing distribution network” (Socor, 2007).

In this pipeline, there was a political controversy because of Gazprom, this pipeline is connected with ArmRosGazprom but Gazprom did not allow them to build a connector pipeline at the initial diameter. Actually, Gazprom inhibited Iran to enter to European oil markets.

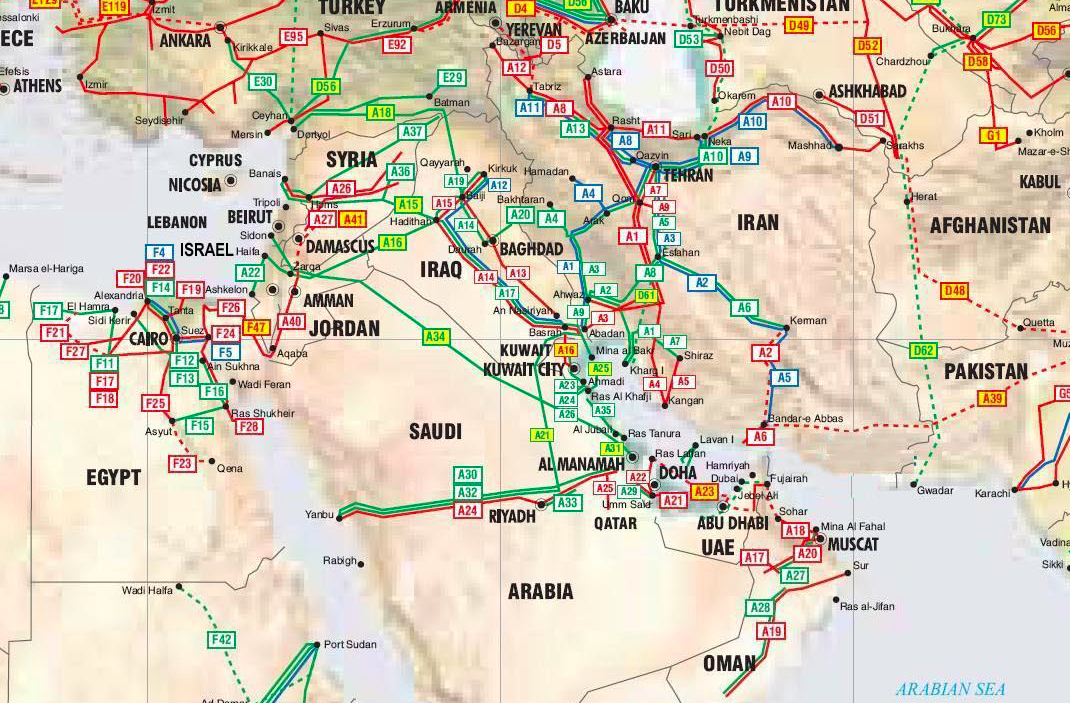

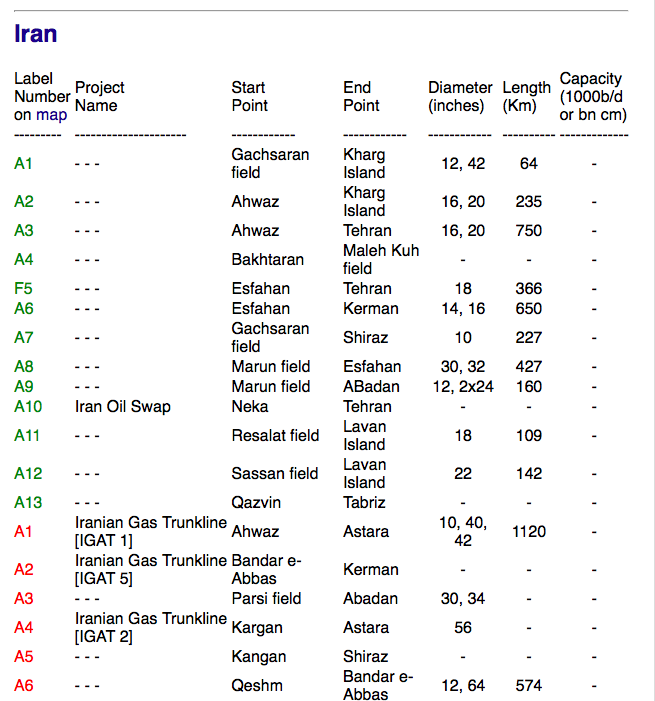

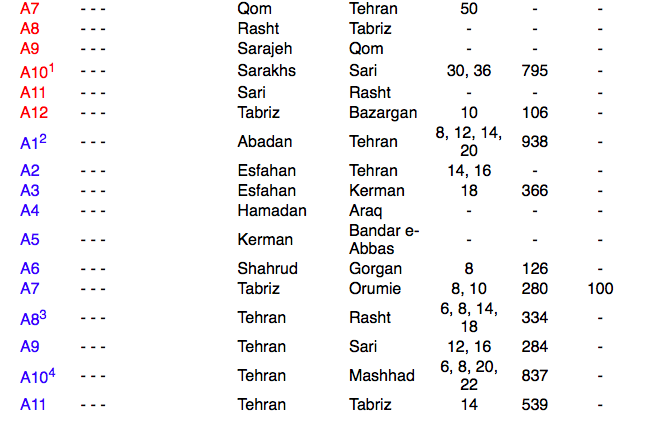

Oil Pipelines

The following figures list the Middle East pipelines, as shown on the map. It is followed by the map, which you can click to see an enlarged version. The pipeline routes on the map are labeled with the codes that are explained in the table. Pipeline label codes are colored green for oil, red for gas and blue for products, such as gasoline, propane and ethylene. The diameter, length and capacity of the pipeline, if known, are shown on the figure below.

Figure 12 - Detailed Outline of Iran Pipeline Network

Source: Theodora, 2013

Figure 13 - Oil Pipeline Statistics of Iran

Source: Theodora, 2013

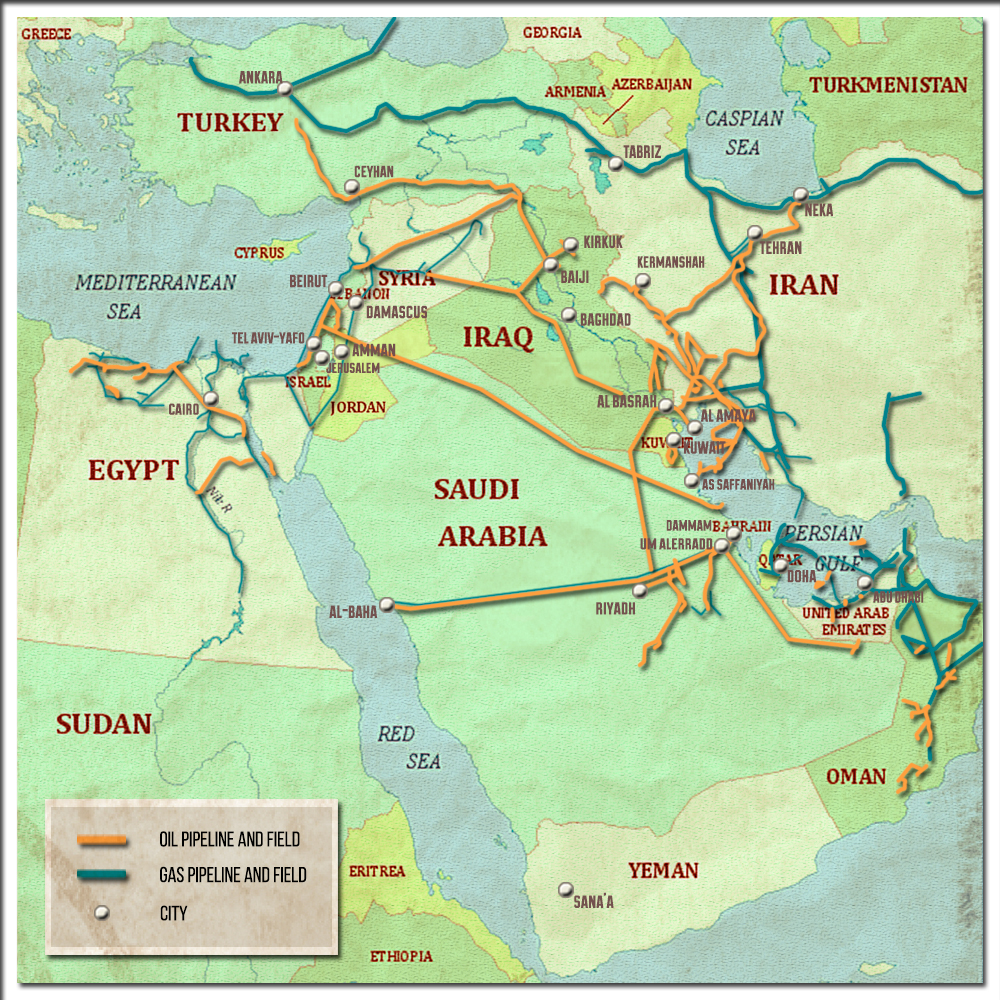

Figure 14 shows that, Iran’s remaining oil pipeline infrastructure connects oil fields within the country and distributes produced oil inside the country, such as Tabriz pipeline, Qom-Isfahan-Kerman pipeline. Iran also has a pipeline that extends to Iraq, which connects to IPSA, which is a pipeline that goes to Red Sea to be exported via ships (Southfront.com, 2015). However, utilization of this corridor for Iran is impossible, as IPSA has been closed since 1990 (Gamal, 2017). Thus, other major oil pipelines do not pose themselves as “exit-strategy” for Iran, except for a potential pipeline from Neka port, which can be used to evade the US sanctions. Neka has direct connection to Iranian oil pipeline structure (U.S. Energy Information Administration, 2018). Thus, it can theoretically be fed with oil extracted from any oil field in Iran.

Figure 14 - Middle East Pipeline Infrastructure

Source: SouthFront, 2015

Figure 15 - Westward Facing Pipelines of Russia

Source: ViableOpposition, 2015

Figure 16 - Major Caspian Oil and Natural Gas Export Routes

Source: EIA, 2013

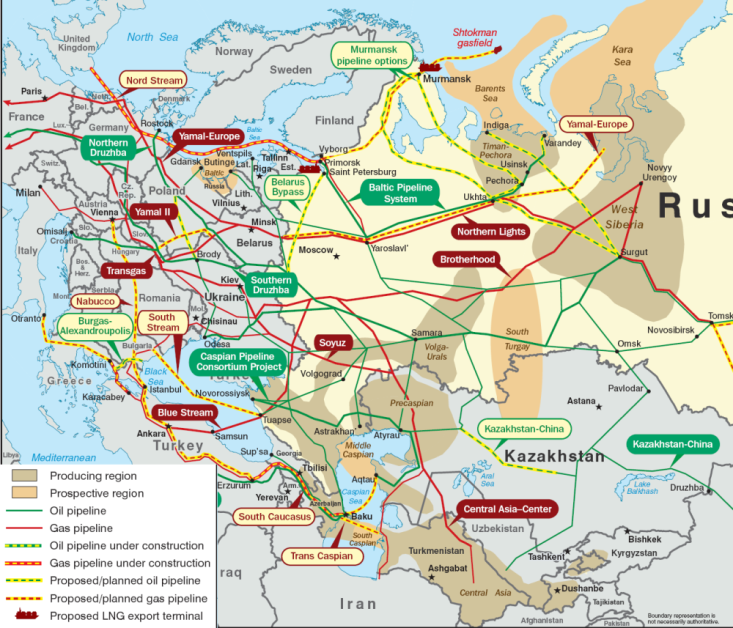

When Figures 15 and 16 are observed, there are two possible port cities that have existing connections to pipeline infrastructure of Russia. Those two cities are Astrakhan and Makhachkala. Both of the ports are connected to Caspian Pipeline Consortium, which also has a connection to the complete oil infrastructure system of Russia. Therefore, the cities have the flexibility to be connected to Europe in addition to Black Sea ports. However, due to direct connection to Novorossiysk of Caspian Pipeline Consortium, Novorossiysk would probably be the main export port for any oil imports from Astrakhan or Makhachkala.

Moreover, crude oil transfers corresponds to 87% of the Makhachkala port’s operations. On the other hand, Astrakhan port is used to export grain to Iran, which corresponds to 80% of the ports total transfer (Louppova, 2017). This means that, Makhachkala is the biggest crude-oil transfer port. The port even has the infrastructure needed to handle up to 5 tankers at a time, which can weigh up to 12 thousand tons (Zohn, Kosarev, Glantz & Kostianoy, 2010). In 2012, there were plans to increase its capacity to be able to handle Panamax types of ships of weight 63 thousand tons (Ziyanov, 2012). Moreover, Makhachkala is ice-free the whole year, and was planned back in 2012 to be used for commercial-scale crude oil transportation to Iran’s Neka port (Kurtulmalayev, 2012). Also, Russian Government announced that, it will be investing in its Caspian ports, mainly in Makhachkala to boost the North-South trade corridor. The aim of Russia is to establish trade routes and ports to increase the trade volume with Iran, even perhaps with India or China (Louppova, 2017).

However, in 2017, Russia banned oil tankers transporting oil with sulfur content above 0.6% from docking in Makhachkala (Shaban, 2018). Iran Light’s sulfur content is around 1.5%, meaning Makhahkala is not a suitable candidate unless Russia lifts the ban (U.S. Energy Information Administration, 2018). Considering that Kazakh oil’s sulfur content is (0.55% - 1.2%), ban was targeted at heavier Kazakh oil (Eurostat, 2018; Shaban, 2018).

On the other hand, Lukoil announced back in 2015 that it would start infrastructure projects to transport and process more offshore Caspian oil and carry it by Astrakhan, and its commitment is still ongoing (Azernews.com, 2018; Lukoil, 2015 2018).

Therefore, considering the ban, Astrakhan port seems to be the most plausible option. However, considering the oil sulfur content limit in Makhachankala is most probably targeted at Kazakhstan Heavy, if Russia decides to make an oil deal with Iran, it can reconsider lifting the ban.

Details of Makhachkala Port and connected Pipelines

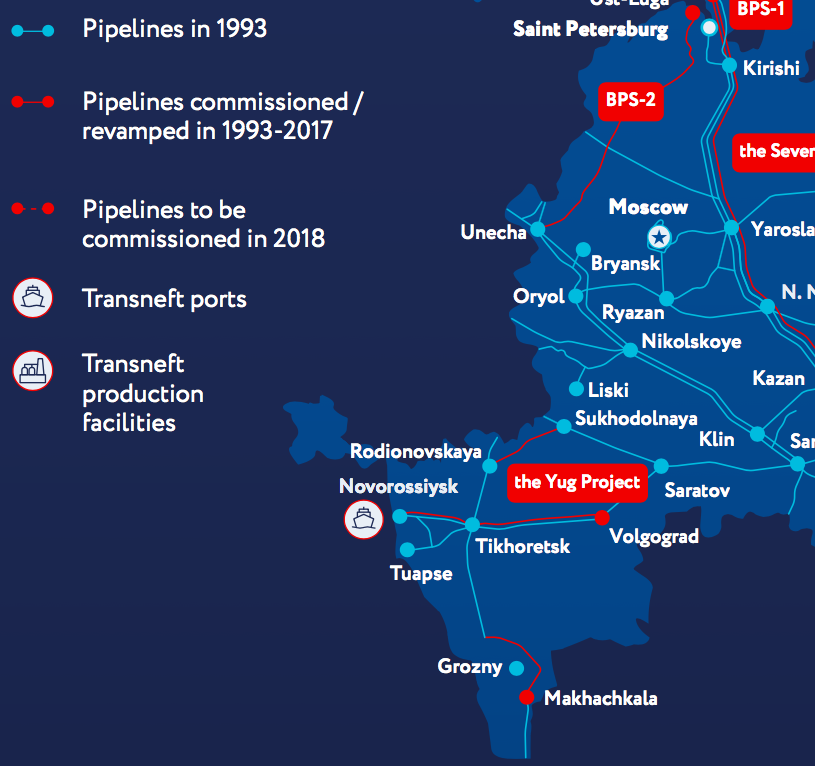

Figure 17 - Baku - Makhachkala - Novorossiysk Pipeline

Source: SOCAR, 2018

This oil pipeline is 1,330-kilometer (830 mil) long and the diameter of the pipeline is 530 mm as Figure 17 show that it starts from the Sangachal Terminal near Baku to the Novorossiysk terminal at the Black Sea coast of Russia (Socar.az, 2018). The Russian section of the pipeline is operated by Transneft and the Azerbaijani section is operated by the State Oil Company of Azerbaijan Republic (Socar.az, 2018) which is 231-kilometer long (Aliyev and Sharifov, 2008). The pipeline runs through Dagestan in Russia and the original route run also through Chechnya as it exploited the existing Grozny–Baku and Grozny–Novorossiysk pipelines (Socar.az, 2018). However, after the Second Chechen War, this part of the pipeline was closed and then, Transneft crated another pipeline as a solution to solve the dispute in this region. “An oil pipeline bypassing the territory of the Chechen Republic was commissioned increasing the reliability of Azerbaijani oil transit via the Baku — Tikhoretsk — Novorossiysk route in 2000 (transneft.ru/investors, 2018)”. “Filling the pipeline with oil started in October of 1996 (Socar.az, 2018)”. The maximum capacity of the pipeline is 105, 000bpd (Socar.az, 2018). From 2006 to 2008, the flow of oil from Azerbaijan to Russia temporarily stopped by Azerbaijan because of price disputes with Transneft. Annually, Azerbaijan International Operating Company (AIOC) has a connection with the government and it transports Azerbaijani high gravity oil. This company produced Azeri oil in the Azeri-Chirag-Gunashli field and this field is linked with the Baku-Novorossiysk pipeline and the Baku-Tbilisi-Ceyhan (BTC). The Baku-Novorossiysk pipeline has a maximum capacity of 5 million tons per year (or 100 thousand barrels/day). According to last reports regarding to Azerbaijan's oil export from Russia, amount of oil supplies were 1.16 million tons, in 2017 between January and September while exports from BTC fell by 7.8 percent to 20.33 million tons (enerjigunlugu.net, 2017). In addition, Azerbaijan will reduce this amount to 1.35 million tons in 2018.

Table 14 - Russia Oil Acceptance Data by Country

|

Oil acceptance and delivery indicators for 2015-2017 |

||||

|

Indicators |

Acceptance in Year (mtoe) |

Change, 2017 vs 2016, % |

||

|

Acceptance into the Russia |

2015 |

2016 |

2017 |

|

|

oil from Kazakhstan |

15.28 |

17.22 |

16.93 |

-1,7 |

|

oil from Azerbaijan |

001.19 |

001.30 |

001.50 |

15,4 |

|

oil from Turkmenistan |

0.76 |

0.44 |

0.00 |

-100 |

Source: (Hilal(?))

The amount of oil that Russia exports from Azerbaijan which can be seen in Table 14, has been increasing since 2015 until 2017. The increased rate in the amount of oil that exported from Azerbaijan is 15.4%.

Oil Types exported via Novorossiysk

Figure 18 - Novorossiysk Pipeline Infrastructure

Source: Transneft.ru, 2018

Connection between Novorossiyks Port and Caspian Pipeline Consortium and Trade

In 2017, the CPC was shipped 55.1 million tons of oil from the Novorossiysk Marine Terminal, 49.5 million tons of oil from Kazakhstan and 5.6 million tons of oil from Russian shippers. Compared to 2016, the volume shipped by the CPC from the Marine Terminal in Novorossiysk increased by 24% or 10.8 million tons.

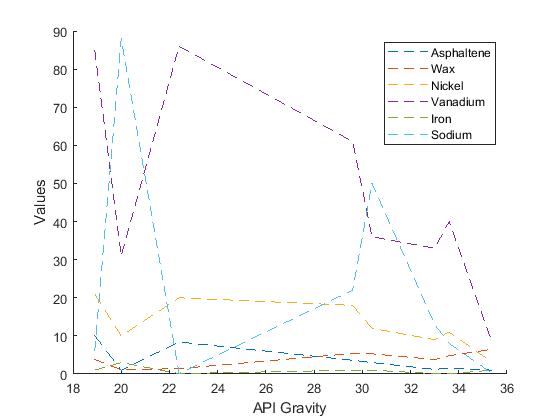

Viscosity, API gravity, sulphur content of oils have been discussed in section 2.1. However, there are other metrics of oils such as asphaltene, benzene, copper, iron, lead, nickel, nitrogen, lead, vanadium, wax, water and zinc content. However, all these numbers are either weakly correlated (nickel, vanadium) or stays relatively unchanged (asphaltene, iron, wax) with API gravity and viscosity or, are relatively insignificant (sodium) compared to viscosity, API or sulphur content (Petroleum.co.uk, 2018; NIOC, 2018).

Figure 19 - How various oil metrics change w.r.t. API Gravity for Iranian Crude Oils

Source: NIOC, 2018

Thus, one should look for oils that have similar API gravity, viscosity and sulphur content values, to get a main idea for possible alternatives. However, this is not a strict alternative, since one can adjust the ratio of mixed oils. Thus, alternatively, a sourer and heavier oil can be used but in smaller ratio instead of Iranian oil to mimic Iranian oil’s effect.

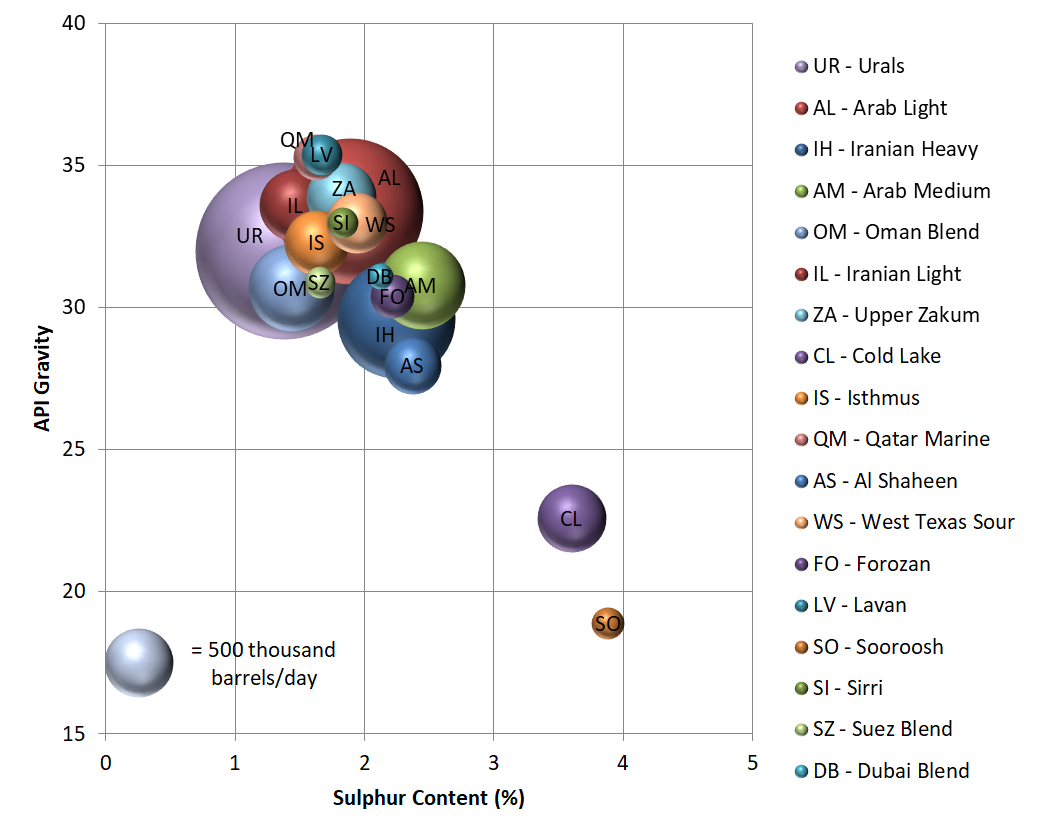

Figure 20 - Metrics of Iranian Oil Blends and Possible Alternatives

Source: Eni Norge, 2018; NIOC, 2018

Figure 20 shows oil blends that are similar to Iranian blends in terms of their API gravity and sulphur content. Further details of the blends that might be alternative to the Iranian blends can be seen in Table 15:

Table 15 - Iran Oil Blend Alternatives

|

Name of Oil Blend |

Origin |

Typical API Gravity |

Typical Sulphur (%) |

Viscosity |

Alternative to |

|

Al Shaheen |

Qatar |

27.97 |

2.37 |

44.06 (20C) |

Iranian Heavy |

|

Arab Light |

Saudi Arabia |

33.4 |

1.89 |

12 (16C) |

Sirri |

|

Arab Medium |

Saudi Arabia |

30.8 |

2.44 |

16.4 (21C) |

Iran Heavy/Forozan |

|

Cold Lake |

Canada |

22.6 |

3.6 |

206 (16C) |

Soroosh |

|

Dubai |

UAE |

31.1 |

2.12 |

13 (20C) |

Iran Heavy/Forozan |

|

Isthmus |

Mexico |

32.3 |

1.63 |

9 (25C) |

Sirri |

|

Oman |

Oman |

30.7 |

1.43 |

- |

Iranian Light |

|

Qatar Marine |

Qatar |

35.3 |

1.62 |

23.41 (15C) |

Lavan |

|

Suez Blend |

Egypt |

30.9 |

1.65 |

23.56 (20C) |

Iran Light/Sirri |

|

Urals |

Russia |

32.0 |

1.37 |

4.92 (20C) |

Iran Light |

|

Upper Zakum |

UAE |

33.9 |

1.82 |

9.6 (20C) |

Sirri |

|

West Texas Sour |

USA |

33.0 |

1.94 |

- |

Sirri |

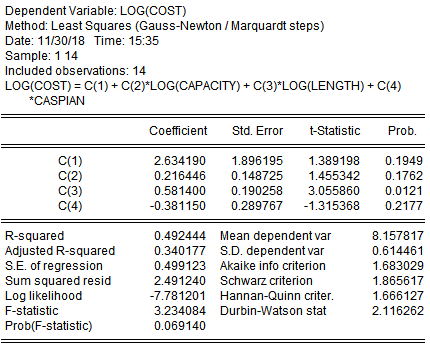

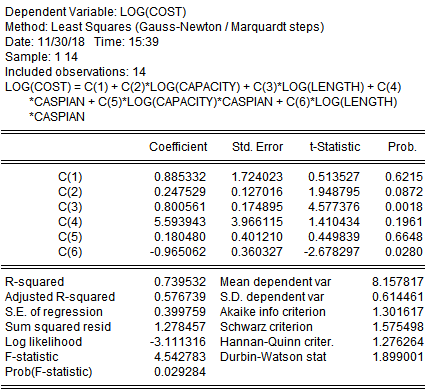

Source: Eni Norge, 2018; ETC, 2018; Total, 2018; ExxonMobil, 2018; Petrotech, 2018